The Spring market is officially here! The Spring (typically March to June if you are a realtor) is consistently the most popular time of year to purchase a home. Why you ask? The spring market brings an increase in inventory of 35-45% from the winter months providing buyer’s with more choices.

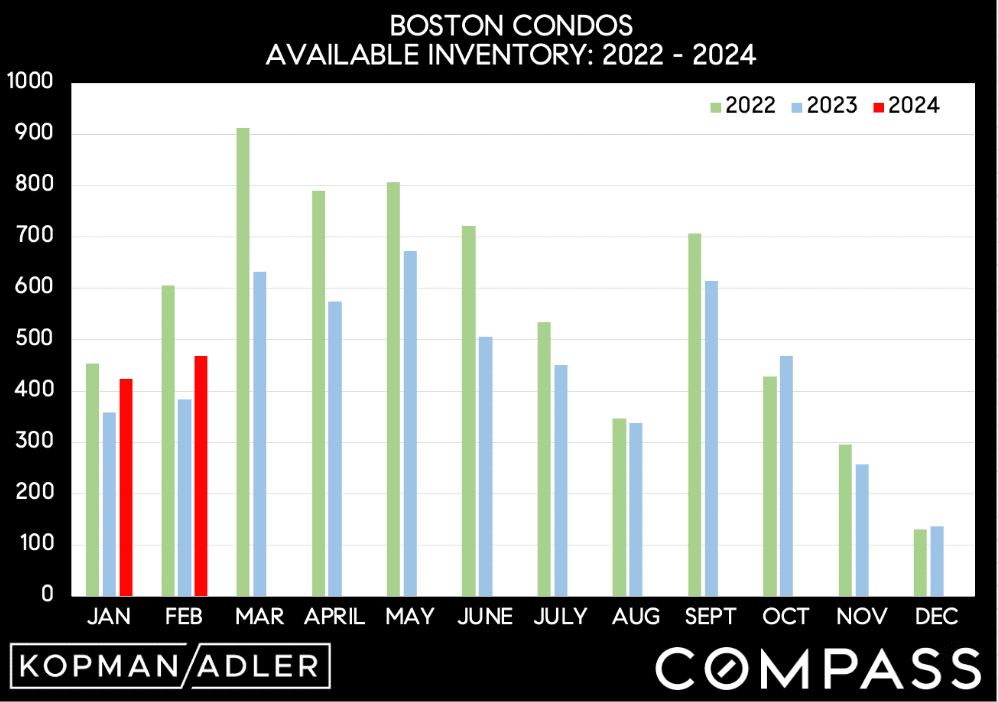

While we are seeing more listings come on the market we are not quite at the 30%+ increase that we expect to see this time of year. There is more inventory compared to last year, but we are still statistically low compared to years past. Compared to 2022, there are 23% fewer properties listed so far this year.

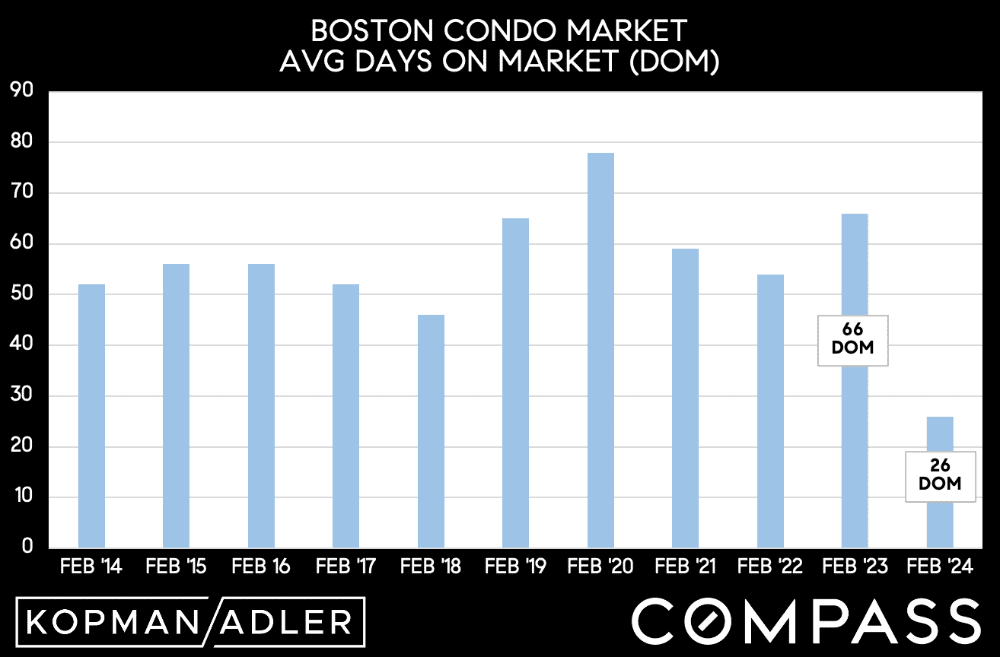

February 2024 saw the lowest Average Days On Market (26 days) in 10 years. The increase of demand coupled with low inventory has resulted in properties going under agreement quickly, more offer competition, and slightly higher sale prices.

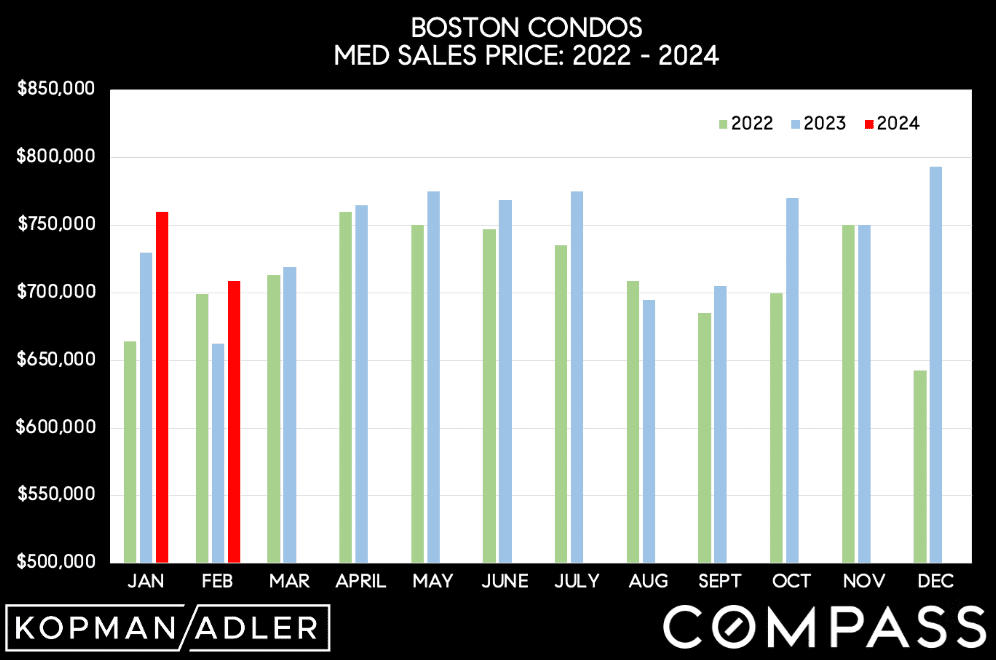

Moral of the story is pretty much the same old same old for Boston - inventory is low, buyers are back and the Spring Market is roaring out like a lion (more than expected). Many buyers have asked if prices are going to fall based on interest rates and we can safely say that we have the data to answer that, no. The higher rates in the second half of 2023 caused sellers to pull their listings from the market which restricted inventory and exacerbated the historic supply vs. demand issue n the the Boston Metro area (per housingwire.com).

What does this mean to our sellers and buyers?

Sellers - while you may be concerned about this high interest rate market and what that means for your home value, you can rest assured we are continuing to see purchase prices increase and more active buyers that we haven't seen since late 2022. Interested in what your home is worth? Give us a call!

Buyers - while steadily increasing home prices is likely not what you want to hear, we are very much on par with the average Year-over-Year trajectory for sale prices (an avg 3-5% increase in sales prices in Boston has been the standard). If you are considering waiting until next year, we predict we will see the same increase in pricing. The good news is that rates are widely expected to fall over the next year. We have lenders quoting in the mid 5.0%’s and we track multiple lender’s rates daily in order to maximize your housing dollars at purchase.

This past February, we saw the lowest average days on market (DOM) when comparing the month of February YoY in the last 10 years. Properties went under agreement at a rate 61% faster this year than last.

Although inventory is up YoY, we are still 27% off of our 2022 February inventory levels. As of today (3/12), we are 23% off of the available inventory level we saw at this time in March of 2022.

Median sale prices have increased 7% YoY. Although we have seen a slight increase in inventory, the dramatic decrease in AVG DOM indicates that there is more buyer competition in the market. The increased competition coupled with still having historically low inventory levels is driving prices up.